E-Commerce Trends Overview

The rapidly growing and changing E-commerce industry, driven by new stores and popping up new business ideas as well as models, call for a revolution in the traditional model on which businesses have been running. Notably, while global E-commerce revenues hit $4.9 trillion in 2021, growth in retail e-commerce is forecast to grow by 50 percent over the next four years, reaching about 7.4 trillion dollars by 2025.

For merchants, SMEs, Startups, either running or plan to start affiliate platforms in-house or on third-party Affiliate Networks platforms, it is time to optimize your platforms to meet the technology requirements to satisfy the demand of Gen Z customers. This is a Must for Business Success in 2023 and beyond.

Mobile E-Commerce (m-commerce)

Mobile e-commerce, [or mobile commerce], refers to online business transactions that are performed using such devices as smartphones, tablets, or laptops. In 2023 and beyond, there will be a surge in the use of mobile devices in online shopping as well as researching various channels. Let’s face it. Shopping via a mobile device is no longer an exception but rather the new normal.

It is not only buying and selling of goods, but with m-commerce, users can, on addition to shopping online, perform functions such as paying utility bills, booking transportation tickets, and conducting other commercial transactions simply with a mobile device.

Moreover, mobile devices can also be used to research information about products or services before the actual purchase. According to Statista, retail m-commerce sales in the United States exceeded 360 billion U.S. dollars in 2022, and are projected to grow almost twofold, amounting to approximately 710 billion U.S. dollars by 2025.

For merchants and managers of affiliate networks who have not yet optimized their affiliate programs/networks to meet this shift, it is high time they did it. Your system should be upgraded/optimized to cater for the following:

1) Integration of mobile commerce apps into your program:

Mobile commerce apps should be integrated into the system that will provide for optimized visual appearances as well as UX/UI elements. This may require a complete overhaul of the system. What do I mean here? The philosophy of “mobile-first experience” must first be embraced and then implemented. This should not be taken to mean just shrinking your desktop experience to a smaller screen, but to create better experiences for users by starting the design process from the smallest of screens. Typically, the design of your platform/online store stems from how it would look on mobile screens, then move onto bigger and bigger screens. With such designing and prototyping, your websites for “mobile devices first” helps you ensure that your users’ experience is seamless on any device.

As of now, it is estimated that two billion people access the internet from their smartphone only, and this number is expected to jump by 72.5% to 3.45 billion by 2025. Therefore, if you are not designing for mobile, your users are more likely to have a less-than-amazing experience. This will be important in 2023 and beyond as consumers will continue to use m-commerce in most, if not all, of their transactions. So, if your program does not cater for m-commerce, it is high time this was integrated.

2) Optimization of search functionality:

Make sure the search experience of your customers that use mobile devices or those referred to your websites by the various affiliates is seamless. This means you should upgrade your platform/program/network to optimize your customers’ search experience for mobile devices. They should be able to view their recent searches and be able to compare current with previous searches in order to make an informed decision on what to purchase

3) Offering phone-friendly payment options:

You have provided a seamless search experience for users of mobile devices and customers who come directly to or are referred to your online store by the various affiliates are satisfied. This is very serious, about 69.8% of shoppers drop off somewhere between filling their cart and making the payment!! What does this mean? It means that the current payment avenues are not convenient for our customers!! Period!

If they decide to make purchases of the desired products and add them to their carts, then make sure payment options are quick and simple to follow and execute. Avoid laborious steps, such as the need to type in their credit cards numbers, which may cause your customers to abandon their carts, thus making a purchase not completed. When upgrading your platform/program/network for m-commerce, ensure that the mobile phone, or tablet, or laptop user can effectively make searches for products and services, and be able to pay effectively and with ease.

Bear in mind the various operating systems used by the various mobile devices and make sure during the process of optimizing, all of the various operating systems can be enabled in the transactions. The most common operating systems used by many mobile devices include: Android, developed by Google, and iOS, developed by Apple Inc. However, when it comes to Samsung mobile phones, they are variations. While most Samsung mobile phones use Google’s Android operating system, a few models use either Microsoft’s Windows Phone operating system or Samsung’s own Bada operating system. Notably, all three operating systems are designed to work well with modern touch-screen smartphones. As such Samsung has also developed a payment app that is suitable for its devices. Below are my 3 best mobile payment services for 2023 and beyond:

Apple Pay – Best for iOS and Mac. Note that the iPhone is the most common brand of smartphone used in the U.S., so it is reasonable to provide Apple Pay as one of the means of payment because it will definitely be widely accepted and used. However, the transaction limit is $10,000, which I think may change to a higher value in the future as m-commerce becomes the most dominant form of doing business.

Google Pay – Best for Android and iOS/Mac. The advantage of using Google Pay is that it is not restricted to Android-built mobile devices but can also be used on iOS devices. So, it covers most smartphones in the U.S. as well as those brands used worldwide, the majority of whom operate on the Android operating system. Besides, it can be used on multiple devices. However, the transaction volume is limited to $5,000, which I think, is very low and as suggested above may change to a higher value in the future as m-commerce becomes the most dominant form of doing business.

Samsung Pay – Best for Samsung phones. Samsung boasts of 16.3 million users, or <20% of the smartphone global share, and hence it is one of the most widely used brands in the mobile phone industry worldwide. As noted above, Samsung customized its mobile devices to operate on either Google’s Android or Microsoft’s Windows Phone operating system, or its own Bada operating system, and hence instituted its own Samsung Pay, suitable for its devices.

Samsung Pay app works on older card readers and can be used to pay for goods and services almost anywhere credit cards are accepted. Moreover, it is free for users and offers standard processing rates for merchants, in addition to offering a points reward system for using its app.

If you are a merchant/advertiser/affiliate network manager, then you need not worry much. Streamline all these options on your system such that every customer referred to your website is served. If you have an older card reader, it should still be accepting Samsung Pay payments. But note that this is being phased out for newer Galaxy models and make plans to upgrade your Samsung Pay app as it evolves with the new technology.

Other payment options which are not directly impacted by the technology brand of the mobile device should also be planned for especially if one wants to connect his/her transaction with his/her bank account. While they are already established and safe ways to facilitate easy online purchases using some of these options, they are other convenient methods that are emerging and especially mobile customers are excited about them.

Those industries moving with the trends have started to provide for them and are busy optimizing their systems to allow for any technological advances that may change the way they are used. Below is my 4 best additional mobile payment option that every merchant/advertiser/affiliate network should provide in 2023 and beyond:

PayPal – Best for Online Shopping: PayPal can be described as one the pioneers in the online payment market and boasts as one of the best-known online mobile payment apps in the world. Despite other players in the market, Pay Pal still commands the lead in online transactions where it has captured 42% of the online payment market share.

Real figures show that PayPal has over 377 million active accounts in 200 global markets, and its customers transacted more than $936 billion in total payment volume (TPV) in 2020. However, the transaction limit range is from $ 4000 to $60,000, which I think may change to a higher value in the future [beyond 2023] as m-commerce becomes the most dominant form of doing business

Merchants, advertisers/affiliate networks, and indeed small businesses are smart to include PayPal as a payment option — especially online. Its online capabilities have been further enhanced by the migration of the horizontally scalable applications of its payment platform to Google Cloud. This is a very significant move as switching to cloud-based transactions will help ensure easy and reliable services for its customers.

Biometrics – Biometric payment is a point-of-sale (POS) technology that uses biometric authentication based on physical characteristics such as fingerprints, to identify the user and authorize the deduction of funds from a bank account. Fingerprint payment, based on finger scanning, is the most common biometric payment method.

To use this method, one needs to create an account through the B.P.S SmartWallet. This takes only a few minutes, after the full ID verification is made. For security reasons, the B.P.S SmartWallet allows users – and only them – to control their own assets from anywhere, as long as they have a mobile device which supports biometric authentication – like a tablet, smartphone or a fingerprint device connected to a PC or Laptop.

This payment method is set to be once of the most popular in the future as it can easily be used by the Gen-z as well as be perfected by AI technology. Vendors/merchants, and indeed the various industries, should consider integrating the biometric payment system, when optimizing their payment system on their various platforms.

QR codes – QR code payment is one of the contactless payment methods where payment is performed by scanning a QR code

from a mobile app. How is payment effected? The process is not a complicated one.

Essentially, to make a QR code payment, the consumer scans, using the smartphone/device, the QR code displayed by the merchant, then enter the amount they have to pay and finally submit. And that is it!! This is a more secure card-not-present method than others.

This method of payment is recognized internationally and has been adopted by many countries in the Asia-Pacific [APAC] region. As highlighted by MasterCard News Release, in APAC, 76% considered payment using QR codes to be cleaner, while 71% considered it more convenient than cash for in-person payments. Moreover, 66% of consumers in Latin America and the Caribbean, and 63% in the Middle East and Africa are expected to use such contactless payment methods as QR in 2022 and beyond, in tandem with the increasing use of m-commerce.

So, as vendors, merchants/ affiliate networks optimize their system for m-commerce, payment by QR codes should be one of the means of payments catered for.

Cryptocurrencies – According to the Mastercard New Payments Index; the acceptance of Cryptocurrency as a payment and trading commodity is raising up, with Millennials primed to jump In. As of now, although consumers can buy, sell, and trade cryptocurrency as a commodity or investment, yet there is a parallel interest in consumers being able to spend crypto assets for everyday purchases.

Importantly, the global interest in cryptocurrencies as a payment method is in ascendancy, with 4 in 10 people (40%) across North America, Latin America and the Caribbean, the Middle East and Africa, and Asia Pacific, say they plan to use cryptocurrency this year and beyond.

Notably, Millennials’, globally, and those in the Middle East and Africa are especially engaged in the cryptocurrency conversation, with more than half (67%) agreeing that they are more open to using cryptocurrency than they were a few years back. In addition, 77% of Millennials’ are interested in learning more about cryptocurrency, while 75% agree they would use cryptocurrency if they understood it well. What does this mean?

It means that cryptocurrency is one of the new payment methods that will be used very much from 2023 and beyond. This means that various merchants/advertisers/affiliate networks, should optimize their payment options to include cryptocurrencies.

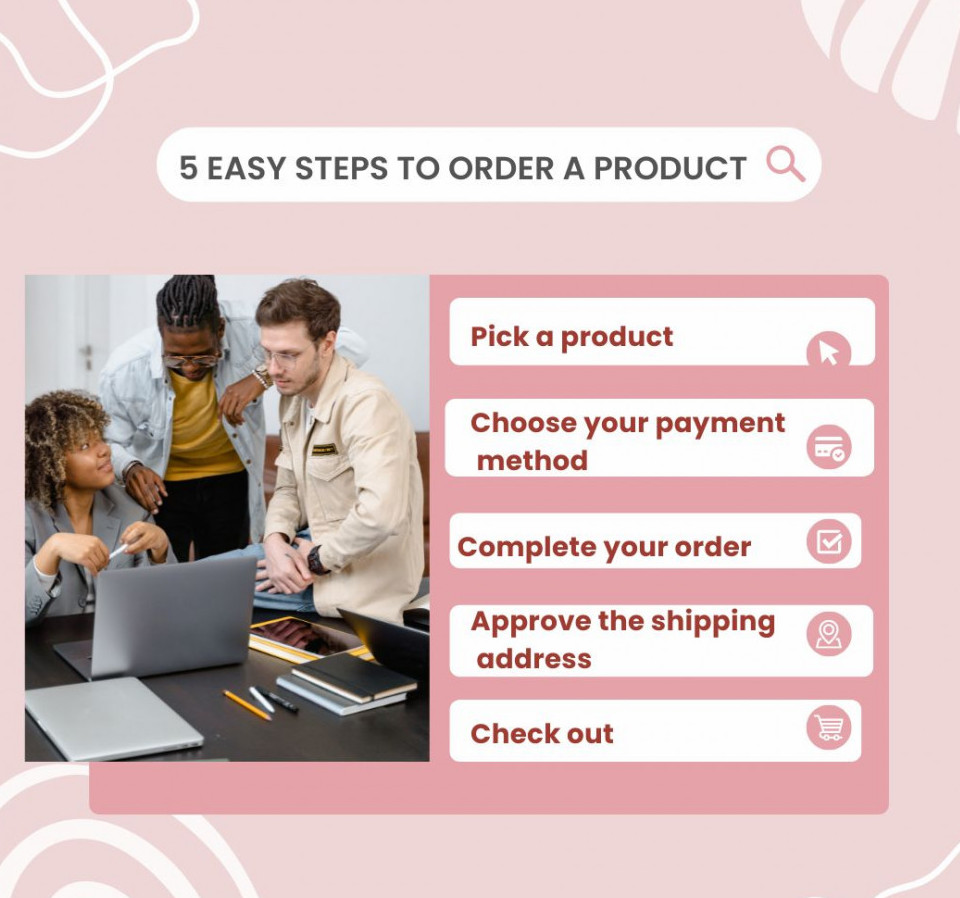

4) Offering a seamless checkout process:

In addition to providing seamless payment methods, the checkout process, should also be made as easy as possible. Merchants/advertisers/affiliate networks should think about how they should provide seamless checkout options for mobile shoppers with services like one-click checkout. As the future predicts a surge in mobile commerce especially, the Gen-Zs, the shopping experience should be made as smooth as possible.

For instance, try to make it simple to enter and exit the cart. Ensure that a mini cart for mobile devices that shows the contents of the shopping cart appears as an overlay when users click on the shopping cart icon instead of taking them to an entirely new screen.

5) Leverage timely communication with customers/Push notifications.

To keep your customers updated, leverage such features as in-app push notifications to notify your customers of special offers and other reminders. Inform them of what is new on the market and what special features are with the new brand, any promotions, and special events. Although push notifications are rarely helpful on their own, they are very useful if they are combined with a full understanding of the customer journey, smart personalization, and clever in-app messaging to make a winning strategy for engaging, converting, and keeping mobile customers.

Understanding and keeping truck of your customers’ journey will be more important this paradigm shift in technology and ecommerce. Optimizing your programs/networks for this change is not only a necessity but rather a must

Is there a Success story?

They are quite several merchants with affiliate programs who are moving with the trends. However, as an example, I will point out one of the world’s largest B2C marketplaces, Amazon, with its Amazon Associates affiliate program. Amazon has moved ahead and has added a payment service, Amazon Pay, which not only makes payment seamless but is also m-commerce focused. In the words of the Amazon Pay Team: “Amazon Pay is a digital payment service that allows customers to make purchases on third-party websites using payment and shipping information stored in their Amazon.com account. Because shoppers don’t have to create new accounts or enter their credit card and billing information, Amazon Pay provides a checkout that is faster, more convenient, and more secure than native checkouts”. This is the way to go, and this is the present “2023”, and the future, “beyond 2023”.

Conclusion

Mobile commerce has come and is going to be the most used avenue for shopping and trade in general in 2023 and beyond. It is supported by new technological advances and a Gen-Z, which is engrossed in the use of smart mobile devices. As Merchants/advertisers and indeed affiliate network managers, you need to evolve with the trends and be able to serve your clientele satisfactorily. Amazon is moving along with the trend and those who are lagging please act before it is too late.

If you have any comments or questions, please leave them in the

comment/question box below and I will make sure you get answered

(probably within 1 hour). Thank you.

Cheers

Joseph Hawumba

Many thanks for publishing such an informative and in-depth post about the latest trends in e-commerce. This is actually a very significant post that needs to be read. Because conducting business online is something that is rapidly becoming more common in today’s society. Everyone is accustomed to conducting business online these days. Keep publishing like this. I most certainly will share this.

Hi, Dimanka, thank you for such an observation. As businesses are going to be predominantly done on mobile devices, SMEs, Vendors/Merchants have to prepare for this shift. Please share this information with as many folks as you can. Thank you, once again.

I appreciate you taking the time to write such an in-depth and helpful piece about the current state of the online shopping industry. There’s no way around reading this piece, as it’s truly quite important. Why? Because transacting online is becoming increasingly commonplace in modern society. Nowadays, doing business entirely online is the norm. Just keep making the same kinds of posts. I will most definitely pass this along.

Always wanted to know more about this subject, especially now that I am working in this sector, thank you a lot my friend, I love what you did please keep putting your time and efforts into it and you will achieve your goals in no time, if you need help please feel free to contact me

Hi, Edoardo, thank you so much for your comment. It is good that this post added to your knowledge of the subject. Indeed, I am continuing to dig deeper into it. Thank you, also for the offer. I appreciate it. Thank you, once again.

Your ideas absolutely shows this site could easily be one of the bests in its niche. Drop by my website Webemail24 for some fresh takes about Escort Services. Also, I look forward to your new updates.

Thank you, Felix, for dropping by and reading this post. Surely, I will also drop by yours. Once again thank you.